Can I Sell My House Back to the Bank?

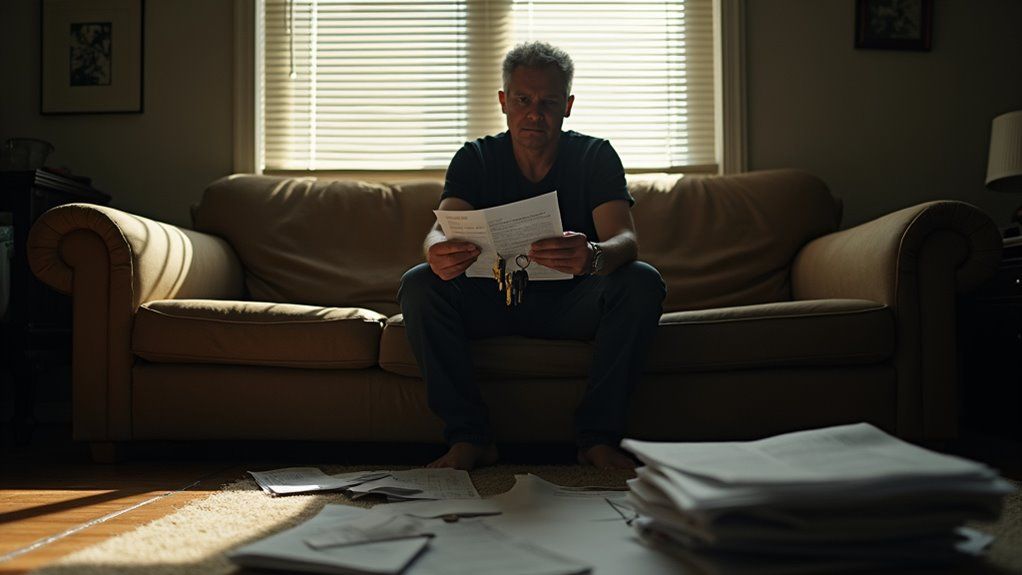

Drowning in mortgage debt with no way out leaves countless homeowners feeling trapped and hopeless. Missing payments creates crushing anxiety, while threatening letters from lenders pile up daily. A strategic exit plan with your bank might offer the lifeline you desperately need.

When financial circumstances become overwhelming, you can indeed sell your house back to the bank. This process, called a deed in lieu of foreclosure, allows you to voluntarily transfer ownership directly to your lender.

In this blog I will explore everything related to selling your house back to the bank.

Key Takeaways

- Yes, you can sell your house back to the bank through a deed in lieu of foreclosure.

- This process requires voluntary agreement, proof of hardship, and proper legal documentation.

- It can help avoid foreclosure, protect your credit score, and reduce stress.

- Tax implications may include taxable forgiven debt, reported via Form 1099-C.

- Early action improves chances of approval and preserves more options for resolving mortgage issues.

What Does “Selling Your House Back to the Bank” Mean?

" Selling your house back to the bank" means transferring ownership to your lender to avoid foreclosure.

This process, called a deed in lieu of foreclosure, happens when homeowners can’t make mortgage payments. You voluntarily give up your property rights instead of going through a lengthy foreclosure.

The main benefit is avoiding the stress and costs of foreclosure proceedings. The lender must formally accept your property deed and release you from mortgage obligations.

This option can help protect your credit score from the severe damage of foreclosure.

However, you must vacate the property promptly after the agreement. As a result, many homeowners consider this a last resort when other options fail.

What Are Your Options if You Can’t Pay Your Mortgage?

If you can’t keep up with your mortgage payments, you need to act fast and investigate your options. You might qualify for forbearance, loan modification, or a short sale, but each has specific requirements and consequences.

Alternatively, a deed in lieu or foreclosure could be on the table—so understanding these choices is crucial to protect your rights and minimize damage.

Mortgage Forbearance

Mortgage forbearance allows you to pause or reduce payments during financial hardship. This temporary relief gives you time to improve your situation without losing your home.

Call your mortgage company right away if you can’t make payments. They can explain your options based on your specific circumstances.

Your lender may offer several relief programs depending on loan type and situation. Federal laws protect homeowners with certain types of mortgages during specific hardship situations. Fast action helps prevent serious consequences like damaged credit or foreclosure.

Beyond forbearance, other solutions might include loan modification or refinancing. The best approach depends on whether your financial challenge is temporary or long-term.

Loan Modification

A loan modification changes your mortgage terms to make payments affordable. It helps you avoid foreclosure when facing financial hardship. Your lender may lower your interest rate, extend your loan term, or reduce your principal.

To qualify, you must provide proof of financial hardship. Complete documentation includes income statements, expense records, and hardship letters. Most lenders require you to be behind on payments or at imminent risk of default.

Several alternatives exist if modification isn’t right for you. Short sales allow property sale below mortgage value. Meanwhile, deed in lieu transfers ownership directly to your lender.

Forbearance offers temporary payment relief during short-term difficulties.

Short Sale

A short sale means selling your home for less than your mortgage with lender approval. This process helps homeowners avoid foreclosure when facing financial hardship.

Contact your lender right away if you can’t make payments. Prepare financial documents that show your hardship situation. Seek help from real estate agents or attorneys with short sale expertise.

The lender must agree to accept less than the full amount owed on your mortgage. Your credit score will still take a hit, but less severely than with foreclosure.

Most lenders prefer short sales because they typically lose less money compared to foreclosure proceedings.

Deed in Lieu of Foreclosure

A deed in lieu of foreclosure lets you transfer home ownership to your lender to avoid foreclosure. This option works when you can’t make mortgage payments anymore.

You must provide proper documentation to make the transfer legal. Your surrender must be voluntary and honest. The bank needs clear proof you’re giving up the property willingly.

Federal regulations protect borrowers from future claims when proper procedures are followed.

This process typically moves faster than traditional foreclosure. You’ll avoid extra legal costs and credit damage. Furthermore, you can negotiate terms that might include relocation assistance.

Foreclosure

Foreclosure happens when a lender takes back property after missed mortgage payments. Act fast to save your home. Contact your mortgage company right away to explain your situation.

Most lenders offer workout options for homeowners experiencing temporary hardship. Research loan modifications that could lower your payments or extend your term.

The foreclosure timeline varies by state law and your loan terms. Additionally, many states provide redemption periods that allow you to reclaim your property.

Professional housing counselors can offer free guidance through this process. Remember, early intervention significantly improves your chances of keeping your home.

How to Sell Your House Back to the Bank?

To sell your house back to the bank, you need to act fast and start by contacting your lender immediately.

Be prepared with all necessary documentation, like hardship letters and financial records, to support your request.

Once negotiations begin, stay clear on the process and requirements to close the deal smoothly and avoid future legal complications.

Contacting Your Lender

Reach out to your lender right away when foreclosure becomes a concern. Quick contact allows you to explore options like deed in lieu or property surrender.

Call your lender’s loss mitigation department today to explain your situation. Be transparent about your financial challenges and what you hope to achieve. Your lender may offer alternatives that aren’t publicly advertised.

Federal regulations give homeowners specific rights during pre-foreclosure, but these protections often have strict time limits.

Furthermore, most lenders prefer negotiation over costly foreclosure proceedings. Early communication demonstrates responsibility and opens more doors for resolution.

Documentation Requirements

You need specific paperwork to surrender your house to the bank. Essential documents include proof of hardship like medical bills or job loss notices.

Financial records such as tax returns, bank statements, and income verification must be submitted completely.

Property condition assessments and current market value estimates are legally required for any deed in lieu process. The bank uses these documents to evaluate your situation fairly.

These materials help establish that you’re surrendering the property voluntarily. Banks carefully review all documentation before approval. Without proper paperwork, your request might face delays or rejection.

Negotiation Process

The bank negotiation process requires documentation, understanding, and strategic communication. Start by gathering complete financial hardship evidence that proves your inability to maintain payments.

Banks typically require proof of income, expenses, and attempts to sell the property at fair market value. Learn the specific requirements your lender has for deed in lieu agreements.

Clear communication builds trust with bank representatives. Show how your proposal benefits them by saving foreclosure costs and administrative hassles.

Act quickly when preparing your offer. Transparency about your financial situation helps establish credibility. Your lender wants solutions that minimize their losses while resolving your situation efficiently.

Closing the Transaction

Selling your home back to the bank requires specific legal documents. You need a voluntary deed in lieu agreement signed by both parties.

Clear title documentation must be provided according to state regulations. Your lender must approve the bank buyback before proceeding.

The process typically takes 30-45 days to complete. Legal counsel can help protect your interests throughout this transaction. Many homeowners find this option preferable to foreclosure.

Federal HUD guidelines must be followed for any bank repurchase arrangement. Act quickly once you decide on this path. Documentation should be organized in advance to prevent delays.

What is a Deed in Lieu of Foreclosure?

A deed in lieu of foreclosure lets you voluntarily transfer your home to the lender to avoid a formal foreclosure process.

However, you’ll need to meet specific requirements, like providing full financial and hardship documentation, and ensure the transfer is completely voluntary.

Keep in mind, this can impact your taxes and credit score, so understanding these consequences is crucial before moving forward.

Requirements for Deed in Lieu

You need to meet three key qualifications to use a deed in lieu of foreclosure. First, provide proof of your financial hardship with supporting documents. Second, disclose your complete financial situation truthfully. Third, ensure the deed transfer is voluntary with proper legal documentation.

This option helps avoid the foreclosure process, which saves time and money. Federal laws require full disclosure of assets and liabilities when applying for this alternative.

Many lenders prefer this route because it reduces their costs too. The process typically moves faster than traditional foreclosure proceedings. Your cooperation speeds things up considerably.

Tax Implications

Yes, a deed in lieu of foreclosure can create tax obligations. The IRS may count forgiven mortgage debt as taxable income.

Federal tax law requires you to report canceled debt exceeding $600 on your tax return.

This can significantly affect your financial situation. The bank will send you a Form 1099-C showing the amount of canceled debt. Some exemptions might apply under the Mortgage Forgiveness Debt Relief Act.

Therefore, consulting a tax professional before proceeding is essential. They can help identify potential exclusions or deductions that apply to your case. Your specific circumstances will determine the actual tax impact.

Impact on Credit Score

A deed in lieu of foreclosure hurts your credit score less than a traditional foreclosure. Your score will still drop by 50-150 points, but recovery typically happens faster.

This option appears on credit reports as “settled” rather than “foreclosed.”

Lenders often view this solution more favorably because you demonstrated responsibility. The negative mark remains on your credit report for seven years regardless.

Many homeowners rebuild acceptable credit scores within 2-3 years with good financial habits.

Taking this route allows you to move forward financially sooner while avoiding the worst credit penalties of foreclosure.

What Are the Pros and Cons of Bank Surrender?

Surrendering your house to the bank can relieve immediate stress, but it’s not without risks.

You need to weigh the benefits, like avoiding a lengthy foreclosure, against strong drawbacks such as credit damage or future financial hurdles.

Understanding the long-term impact is crucial before making this crucial decision.

Benefits of Selling to the Bank

Selling to the bank offers several key advantages when facing possible foreclosure.

You can quickly reduce or eliminate your mortgage debt. The process helps you avoid complex foreclosure proceedings that damage your credit score.

Banks may forgive remaining loan balances in some cases. This approach demonstrates financial responsibility despite hardship.

Furthermore, you maintain some control over the timeline. Many homeowners find relief knowing they’ve taken proactive steps rather than waiting for foreclosure. Different states have varying laws about deed in lieu arrangements.

Additionally, you preserve some dignity through this structured solution. The bank must accept your offer voluntarily.

Drawbacks to Consider

Surrendering your home has serious consequences for your future. A deed in lieu will lower your credit score and restrict future loan options.

Strategic default exposes you to potential lawsuits from lenders seeking payment. Legal action may continue for up to seven years depending on state laws. Some homeowners face tax implications when debt is forgiven.

Furthermore, walking away affects your housing stability and community connections. Many former homeowners struggle to rent immediately after surrender.

Alternative solutions like loan modifications or short sales might offer better long-term outcomes.

Long-term Financial Impact

Giving up your home affects your finances for many years. This decision may solve immediate debt problems but creates future challenges.

You can resolve underwater mortgages quickly when you surrender property. Some lenders offer favorable settlements that reduce your overall debt burden.

Your credit score will likely drop by 100-150 points after foreclosure or short sale. This credit damage lasts up to seven years on your report.

Furthermore, future mortgage lenders may require a waiting period before approving new loans. The tax implications also deserve careful consideration.

What Are Alternatives to Selling to the Bank?

You don’t have to give up your home without exploring all options. Selling to a cash home buyer, listing traditionally, renting out your property, or refinancing could help you avoid foreclosure and keep control.

Act quickly—each choice comes with its own risks and benefits, so weigh them carefully.

Selling to a Cash Home Buyer

Cash home buyers purchase properties with immediate payment. They offer a fast alternative to traditional home selling. This process works well for urgent financial situations.

You can skip lengthy bank procedures when selling distressed properties. People facing foreclosure benefit most from this option. The speed provides relief during housing crises.

Additionally, quick sales prevent further housing market disruption. Meanwhile, you receive funds without waiting months for closing.

For many homeowners, this represents a practical solution to pressing financial problems.

Traditional Home Sale

A traditional home sale lets you pay off your mortgage when facing financial trouble. You can list your property on the market and work with real estate agents. This method often yields the highest selling price.

Your options include regular sales, short sales, and seller financing arrangements.

Regular sales offer quick resolution but may require selling at a loss. Short sales help avoid foreclosure yet can affect your credit score.

Additionally, seller financing gives buyers more flexibility but extends the sales timeline.

Consider your timeline and financial situation before deciding. In most cases, traditional sales provide a stable path forward.

Renting Out Your Property

Yes, you can generate income by renting your property during financial hardship. Leasing your home helps cover mortgage payments and prevents foreclosure.

Short-term rentals often yield higher returns than traditional leases. Your rental income can provide immediate cash flow.

Consider different rental arrangements based on your financial needs. Property owners can legally rent out rooms or the entire house while maintaining ownership. Many lenders prefer this solution over foreclosure proceedings.

Additionally, rental income might qualify as proof of financial recovery to lenders. The property management approach offers both immediate relief and long-term stability.

Refinancing Options

Refinancing can lower your monthly mortgage payments when you face financial difficulties. You might qualify for programs that modify your loan terms or interest rate. A lender can extend your repayment period to make payments more manageable.

In many cases, lenders prefer refinancing over foreclosure because it saves them money too.

Federal programs like HARP and FHA Streamline offer special refinancing for underwater or struggling homeowners. Furthermore, some options require minimal documentation or credit checks.

Contact your current mortgage servicer first to discuss available options. Remember that timing matters - seek help before missing payments.

How Fast Can You Resolve Mortgage Problems?

Most mortgage issues can be resolved within 30-90 days with prompt action. Quick solutions include loan modifications, forbearance plans, and deed-in-lieu arrangements.

Your timeline depends on your specific situation and chosen solution path. Loan modifications typically take 30-45 days to process once all paperwork is submitted. Temporary forbearance can often be approved within 7-14 days.

Remember to contact your lender immediately when problems arise. Early intervention prevents complications and preserves more options.

Many lenders offer streamlined processes for homeowners who reach out before missing multiple payments.

Need to Sell Your House Fast? Contact Tulsa Home Buyers Today

Tulsa Home Buyers can help you sell your house quickly. We purchase homes directly from owners facing urgent situations. Our team provides fast cash offers without the delays of traditional real estate sales.

Financial challenges like negative equity or foreclosure require immediate action. Most homeowners can complete the entire sale process in as little as 7 days.

You won’t need to make repairs or pay closing costs.

Additionally, we handle all paperwork and legal requirements. This approach helps you avoid complicated proceedings and start fresh sooner.

Many clients appreciate the straightforward process and personal attention.

Frequently Asked Questions

Can I Negotiate a Deed in Lieu With My Lender in Tulsa?

Yes, you can negotiate a deed in lieu with your Tulsa lender. Act quickly, provide full financial disclosure, hardship proof, and property info. Contact your lender early to investigate this option and avoid foreclosure.

What Documentation Is Required for a Deed in Lieu in Oklahoma?

You need to provide hardship documentation, property condition reports, full financial disclosures, and possibly an estoppel affidavit. Act quickly, gather all required paperwork, and contact your lender immediately to investigate your options and serve your best interests.

Are There Legal Risks in Voluntarily Surrendering My Home in Tulsa?

Yes, voluntarily surrendering your home in Tulsa carries legal risks like significant liability for unpaid balances or junior liens. Act quickly, communicate openly with your lender, and consult an attorney to protect yourself and serve your best interests.

How Does a Deed in Lieu Affect My Credit Score?

A deed in lieu usually lowers your credit score less than foreclosure, but it still impacts it significantly. Act quickly, communicate openly with your lender, and seek guidance to protect your credit and help others avoid foreclosure hardships.

Is a Deed in Lieu a Better Option Than Foreclosure in Oklahoma?

Choosing a deed in lieu can be gentler on your credit than foreclosure, helping you move forward faster. Act now, contact your lender early, and investigate this alternative to protect your future and serve your family’s best interests.

Ready to work with Tulsa Home Buyers?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at (918) 516-8951