How Foreclosure Affects Your Credit Score

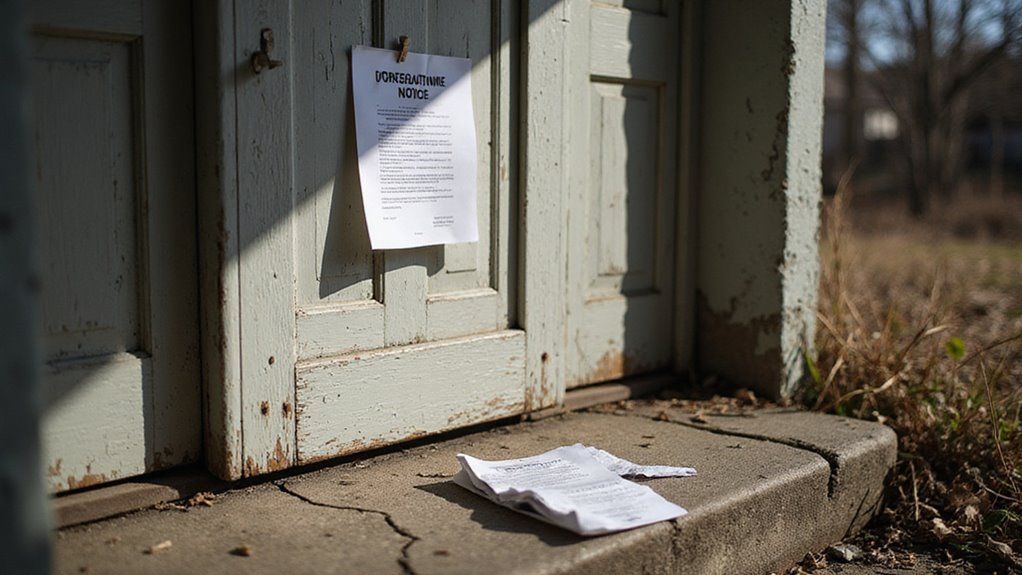

Facing foreclosure is a daunting financial challenge. It’s a situation many dread, as it threatens your home and stability. The stress of losing your property can weigh heavily on your mind and future plans. This crisis demands urgent attention to mitigate its severe consequences.

Foreclosure doesn’t just risk your home; it devastates your credit score. A drop of 100-160 points can happen overnight. This drastic decline signals to lenders that you’re a high risk. It’s a barrier to financial recovery and trust. But there’s hope if you act wisely.

Foreclosure’s harsh impact on your credit score can be managed with smart steps. Seek alternatives like loan modifications or short sales. Consult professionals to explore options and rebuild your credit over time. This blog will guide you through overcoming foreclosure’s credit damage. Stick with us for practical solutions.

Key Takeaways

- Foreclosure significantly lowers your credit score, often by 100-300 points, depending on your initial score.

- The impact is harsher for high credit scores, dropping them from excellent to fair.

- A foreclosure stays on your credit report for seven years, signaling risk to lenders.

- Future loan approvals become tougher, with stricter rules and higher interest rates.

- Rebuilding credit requires consistent bill payments and debt reduction over time.

Immediate Impact of Foreclosure on Property

When foreclosure hits, you’ll notice a significant drop in your credit score almost immediately, as it signals a major financial failure to lenders. If you’ve got a high credit score to start with, expect an even harsher impact, since the fall from a stronger position is more pronounced.

Brace yourself for this sharp decline, as it’s a critical factor in how lenders view your reliability moving forward. Quick home transactions can offer a lifeline by helping to avoid foreclosure consequences before they further damage your credit.

Significant Drop

Foreclosure causes a sharp fall in your home’s value, often dropping by 20-30% instantly. This decline reflects how buyers view foreclosed homes as risky. If you try to sell, your equity could disappear quickly. When refinancing, you might face a huge loss too. Market demand shrinks, pushing prices even lower.

The stress from this can harm your health, both mentally and physically. If stigma hits, social ties may suffer. Foreclosure’s impact is harsh and immediate, affecting many aspects of life.

Worse for High Scores

Foreclosure hurts everyone, but it hits hardest if you have a high credit score. When your score is excellent, a single foreclosure can drop it by 100-160 points. This drastic fall pulls you from great to fair or worse instantly. Lenders notice this mark, and it stains your financial record badly.

The consequences are tough for those with elite credit scores. You might face higher interest rates on loans now. Loan approvals could become harder or come with stricter rules. If you’ve built strong credit over years, foreclosure wipes out that effort fast. The higher your score, the more painful the loss becomes.

Maintaining a good credit score involves paying your bills on time, keeping credit card balances low, and avoiding excessive new credit applications. Monitor your credit report regularly to check for errors or fraudulent activity. Keep old credit accounts open to build a longer credit history, and aim to use less than 30% of your available credit limit. A mix of credit types—such as credit cards, auto loans, and mortgages—can also help strengthen your score. Responsible financial habits and consistent monitoring are key to maintaining a strong credit profile over time and improving your chances for loan approvals and better interest rates.

Long-Term Effects of Foreclosure on Property

When you face a foreclosure, you’re looking at a seven-year impact on your credit report, marking a significant hurdle in your financial recovery. You’ll find it much tougher to secure loans, as lenders view you as a higher risk due to this blemish on your record. Expect higher interest rates on any credit you do manage to obtain, reflecting the long-term cost of this setback.

Additionally, a foreclosure can mimic the severe credit damage caused by bankruptcy filing impact, further complicating your ability to regain financial stability.

Seven-Year Impact

A foreclosure can stay on your credit report for seven years. This mark affects your financial stability significantly. It shows risk to lenders, making loans harder to get. If you improve other habits, this negative still overshadows them.

This seven-year period acts as a constant hurdle. Recovery takes effort while the foreclosure lingers as a reminder. If emotional stress hits, it may last as long. Stay proactive and manage finances carefully to lessen this impact.

Difficulty Securing Loans

Securing a loan after foreclosure is very hard. Lenders see you as a risky borrower. Your credit score often drops by 200-300 points. This makes meeting strict loan rules tough. Most banks avoid approving loans for 3-7 years. They usually set a long waiting period for mortgages.

Don’t give up on your goals. If banks deny you, try private lenders. Government-backed programs might offer flexible options. Rebuild credit by paying bills on time. Reduce your debt to improve chances. If you stay consistent, qualifications become easier over time.

Higher Interest Rates

Foreclosure brings a tough reality for borrowers. Lenders view you as a higher risk after this event. They charge more interest on future loans. This can slow your financial recovery. If economic trends tighten lending, it gets harder.

Consider these impacts on your loans:

- Mortgages: Rates climb much higher, raising your monthly costs.

- Auto Loans: Car financing turns expensive with bigger interest.

- Credit Cards: APRs jump, making debt grow quickly.

- Personal Loans: Emergency borrowing becomes pricier than before.

- Refinancing: Getting better loan terms feels almost impossible.

Focus your investment plans on credit repair. Build savings too. If challenges arise, you’ll be ready for them.

Conclusion

In conclusion, foreclosure can severely damage your credit score. It remains on your record for seven years. This impact can block loans and raise interest rates. If you’re struggling, you must act quickly to lessen the harm.

If foreclosure looms, consider selling your home fast. We buy houses for cash at Tulsa Home Buyers. This option could help you avoid credit damage. Should you choose this, you can move forward sooner.

Don’t let foreclosure define your financial future. We urge you to reach out for help. Contact Tulsa Home Buyers today for a fair cash offer.

Ready to work with Tulsa Home Buyers?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at (918) 516-8951